The technology is coming but what does it mean?

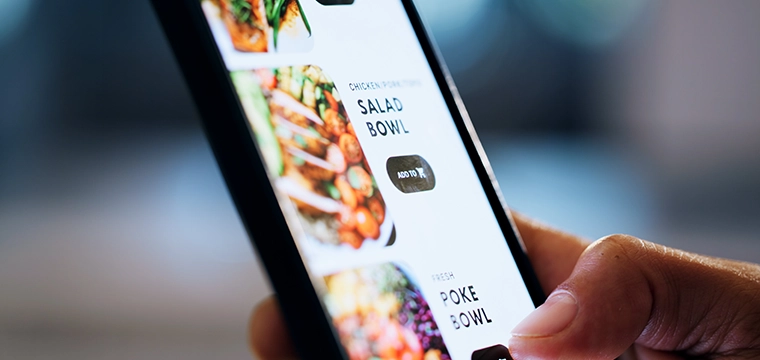

Any campus that accept credit or debit cards should be preparing for the liability shift. Point-of-sale systems in the bookstore, dining facilities and even vending machines will have to be upgraded if branded cards are accepted and the university wants to avoid the liability shift.

According to one campus card industry expert that wished to remain anonymous, card providers and campuses are racing to meet the liability shift. Upgrading point-of-sales systems, payment terminals and back-end systems is a priority so universities will be in compliance in order to accept EMV cards by October.

There’s a lot of confusion about EMV, what it is and how it’s going to impact campus card banking relationships. For example, a Midwest university interviewed for this article reported that it began issuing EMV cards in January.

Upon further investigation, that wasn’t the case. They were issuing a new contactless card that can be used for closed-loop payments on campus, but this is quite different from EMV. The campus card includes Visa-branded debit so the program does fall squarely into this fall’s liability shift impact.

There will likely be some big changes coming to that card program if the card-issuing bank decides to avoid the liability shift and issue EMV cards. New equipment will have to be used in order to encode the contact chip, updates to backend systems will be required and existing cards will need to be reissued.

Universities with these types of programs need to work with their financial service partner to find out how they will accommodate these changes, determine a plan and decide if any modifications will be enacted in the coming months in advance of the October 2015 deadline. The liability shift is a only months away, so if banks aim to hit the deadline new cards will have to be issued when students come back in the fall.