At the University of Southern California a new payment option called ZOOP™ is undergoing its first U.S. test. Created in Korea, the system is a “point and pay wireless service” that utilizes the infrared capability of a cellular telephone to beam payment account information from the telephone handset to the payment reader.

The Center for Telecom Management at USC’s Marshall School of Business is studying the technology and its acceptance in cooperation with the technology’s developer ZOOP International, the U.S. subsidiary of the Korean telecommunications company, Harex InfoTech. The plan is to investigate the issues relating to the marketability of wireless payments on college campuses.

USC’s campus ID card is already used for purchases and various services across on campus but the ZOOP™ trial is a cardless alternative to this and other payment methods. While the infrared technology is only being tested for merchant payments at the moment, it is technically capable of transmitting a student ID number for use in libraries or administrative locations. Could this technology eventually replace the campus ID card? Only time will tell.

ZOOP™ and Visa in Korea

Visa International worked alongside Harex InfoTech to bring credit and debit payment services to wireless devices using infrared technology. The results of that collaboration is the ZOOP™ product that enables customers to simply beam their financial information from mobile handsets to make payments based on the Visa Proximity Payment Specifications. ZOOP’s first deployment was in South Korea in March 2002.

According to Michael Watson, Senior Vice President of ZOOP International, more than 20,000 merchants are currently enabled or being enabled to accept ZOOP™ payments in Korea. This list includes major department stores, cinemas, and eating establishments such as TGI Fridays, Kentucky Fried Chicken, and Starbucks. In the city of Seongnam initial trials were extremely successful with the town reported to be well on its way to becoming a cash-free zone.

Pay by phone, the next generation?

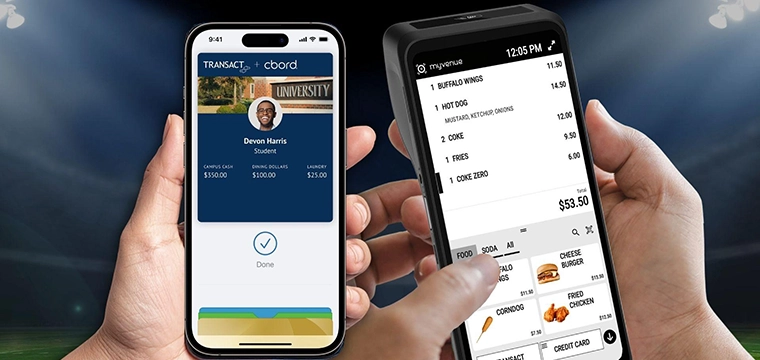

Students and faculty participating in the USC trial use the HandSpring Treo Communicator brand of cellular telephone. With the Zoop™ payment application loaded, the phone is ready to send data via the phone’s infrared transmitter. Infrared receivers attached to the point of sale terminal at a participating merchant enable the data sent by the phone to be passed into the payment network. That “Virtual Visa Card” data is accompanied by a user-entered personal identification number (PIN) and the transaction is routed to through the normal payment card processing network. To the network the ZOOP™ payment looks and acts just like a normal credit or debit card payment.

The $30 infrared receiver can be attached to any point-of-sale terminal equipped with a standard serial port, enabling widespread merchant participation without the need for major point of sale terminal replacement. This solves one of the major issues that has plagued the adoption of smart card technology in the U.S.–the resistance from merchants to buying new equipment to accept the new technology. And, receivers can be attached to vending machines, access control systems, and PCs.

Says Mr. Watson, “The USC trial will be run in multiple phases. The first phase will allow students, faculty and staff to make wireless payments in the campus bookstores and dining facilities. The second phase will include additional venues such as the sporting events. The final phase will include parking, vending, and some merchants off-campus.”

The outlook for mobile payments

Among USC’s 30,000 students, as it is throughout society, mobile phones are commonplace. ZOOP™ technology may eventually help expedite transactions, thus reducing congestion in high-traffic areas. It also could one day improve efficiencies in administrative areas such as tuition payment, class registration, and library checkout. Or the research may show that ZOOP™, like many new payment technologies that came before it, is eventually deemed to be “neat” but unnecessary among the cash and card loving Americans.