Declining balance and replacement card fees no longer sufficient to cover expenses

Like other institutions, University of Connecticut students pay mandatory fees to fund various non-academic programs and services. One of these fees, UConn’s General University Fee, helps support the One Card Office as well as Recreational Services, the performing arts center, Student Activities, the Student Union, and more.

The General University Fee for the 2024/2025 academic year is $785 for full-time students and $393 for part-timers.

According to the UConn student newspaper, The Daily Campus, this fee is expected to increase by $98 next year.

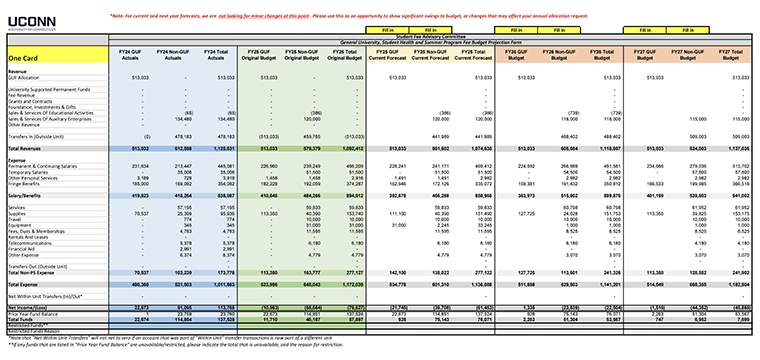

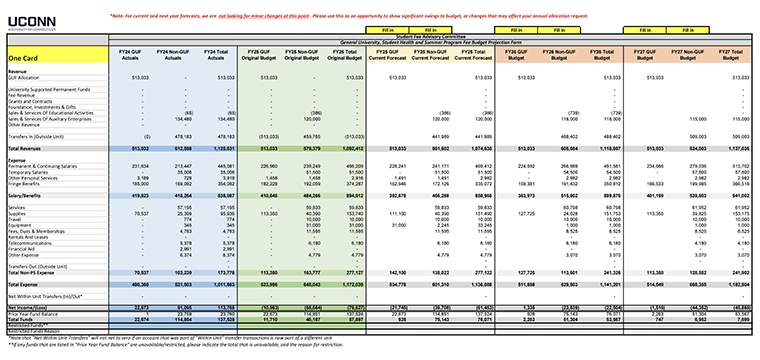

The report and detailed budget submitted by the One Card Office provides a rare view into the financial challenges facing card offices today.

The Student Activity and Service Fee Advisory Committee (SASFAC) asked departments that receive a portion of these fees to make requests for increases and defend the utilization of the dollars. Each department submitted a report with both a Q&A section and a detailed budget.

The response submitted by the One Card Office provides a rare view into the financial challenges facing card offices today.

While other departments asked for immediate increases in their allocation of the fee, the One Card Office suggested that an increase will be necessary in future years. The main reason cited is falling revenues from both replacement card fees and transaction fees from the closed loop debit card known as Husky Bucks.

Currently the office charges $30 for a replacement card and a Husky Bucks transaction fee of 7%.

UConn One Card Office annual revenue from replacement cards and Husky Bucks fees.

While the card replacement revenue has recovered and even overtaken pre-Covid levels, the office reports that rising card costs will cause this revenue stream to decline in the coming years. In the past few years, the revenue from replacement cards has hovered just below $70,000.

The Husky Bucks program however, has not rebounded. In 2019, the program generated nearly $80,000 for the One Card Office. This year that number will be just $30,000.

Operating account revenue, ID replacements and Husky Bucks revenue have been on the decline and are not enough to cover expenses.

The report does mention that they anticipate some increase in Husky Bucks revenue with the launch of Grubhub in early 2025.

The One Card Office is currently using its leftover funds balance to bridge the financial gap. “Operating account revenue, ID replacements and Husky Bucks revenue have been on the decline and are not enough to cover expenses,” notes the report.

Other complicating factors include projected salary increases; fixed expenditures such as replacement of ID card printers; and renewal of the CBORD contract that ends in 2028.

Costs continue to rise. Declining balance programs become less profitable – or even shut down. Replacement card revenues drop.

The report also notes a potential move to mobile credentials, something that would further impact office funding. Mobile credential programs typically eliminate replacement card revenue and require new recurring license fees.

It's a bit of a perfect storm.

Costs continue to rise. Declining balance programs become less profitable – or even shut down. Replacement card revenues drop.

None of this is unique to UConn. Card programs across the country are facing similar challenges as next generation technology collides with last generation business models.

What is unique about UConn is this report gives us a chance to see these impacts firsthand.

Click here to review the One Card Office's Q&A and budget.