Campus card offices lose bank partners, financial aid offices lose outsourcing

It was more than three years ago that US PIRG released its report damning the relationships between financial providers and academic institutions that provided payment card products to students. In its wake, other reports from the agencies like the Government Accountability Office, Congressional hearings and consumer protection efforts followed. Then came the Department of Education's efforts to revamp financial aid disbursement.

The DOE convened a 2014 Negotiated Rulemaking Process to gather input from a cross section of concerned groups. After months of meetings and drafts, negotiators reported that they thought they had successfully re-crafted the rules. But representatives from industry and the consumer advocacy groups failed to reach total consensus, leaving the DOE free to draft the rules as they saw fit.

In mid-May, the DOE’s final proposed rules were released, and they are not favorable for industry, campus administration or even students. They appear to be a win only for the consumer advocacy groups that have been pushing to have banks and payment cards completely removed from the process.

Since the Negotiated Rulemaking began, both the service providers and the campuses relying on them to disburse financial aid to students have been on proverbial pins and needles. The future of this line of business and peripheral services -- such as campus card and bank partnerships that deliver accounts and debit cards to students -- have been up in the air.

I have written about this many times before and have worked with associations, providers and campuses attempting to plan for the future. The goal has been to help the DOE develop productive regulations that protect students and grow these services. But from the beginning, the car has been driven by consumer advocacy bodies that seemed devoted to the banishment of these relationships from higher education.

Still I always believed that cooler heads and data-driven decision making would prevail. After all, I know that the vast majority of these services are beneficial for campuses and students alike – better in most cases because the campus is involved on the student’s behalf.

I kept this cautious optimism throughout the negotiated rulemaking process, loads of phone briefings, several years of conference sessions and a series of draft proposals and comment periods.

I am no longer optimistic.

I fear that the draft regulations released by the DOE in May are likely to pass without significant changes. I have heard no insider intel to suggest that the comment period that ends on July 2 will produce substantive change.

For the first time, this has me thinking about worst-case scenarios. What if the consumer groups get their wish and some or all of these relationships that both campuses and students rely on actually do go away?

As both a student and a university employee, I remember the “net check” process where everyone receiving aid had to get it via paper check. It was painful on both sides. Are we destined to relive it? As other federal programs from Social Security to Veterans Affairs totally eliminate checks, is the DOE pushing campuses backward?

Do they think forcing campuses to manage ACH processes in-house, increase the use of paper checks and push students to use their existing bank accounts really solves a problem students are facing? Many paper checks will be cashed at rip-off payday loan shops. The students’ preexisting bank accounts all charge non-sufficient fund and other traditional fees the DOE is trying to eliminate.

Sadly, many of the products the new regulations will curtail actually are better, as they offer low- or no-fee alternatives that help students access Title IV funds. In the rush to appease the consumer advocates, it seems the DOE has overlooked this reality.

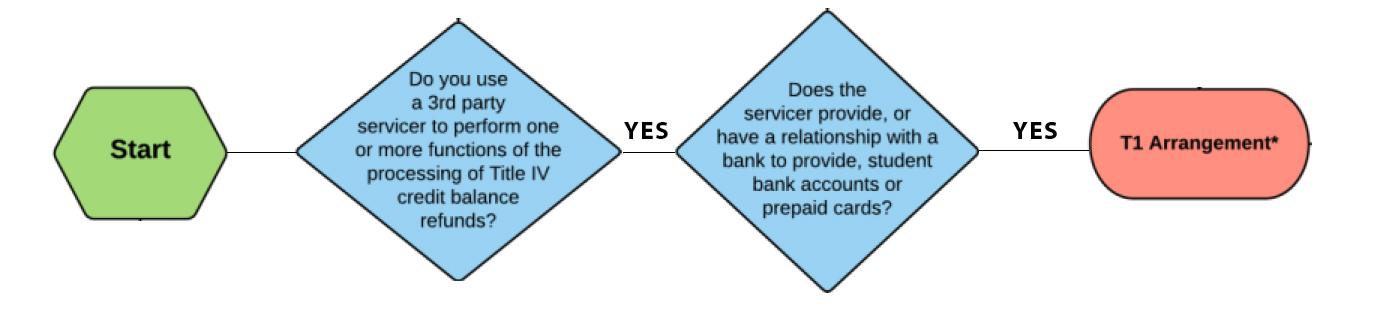

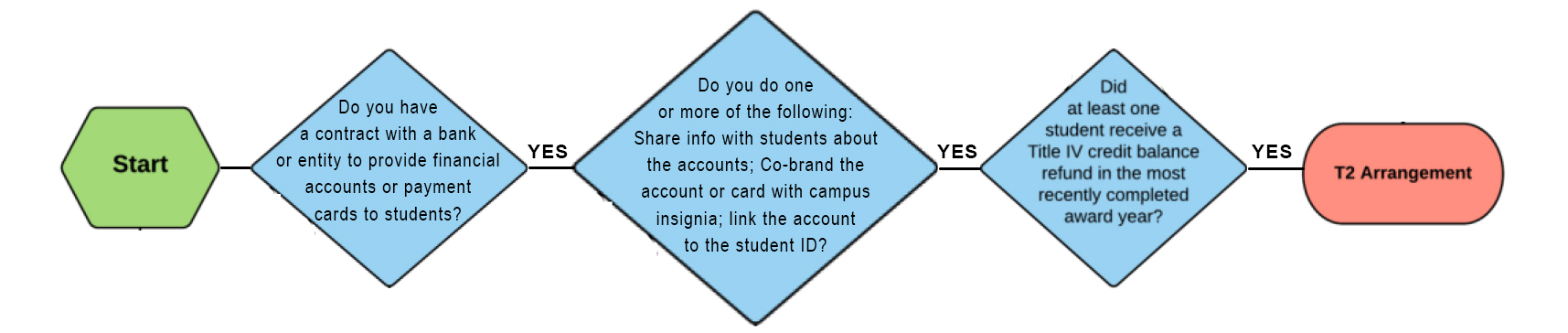

NACUBO created a flowchart to enable a campus to determine whether or not they have a T1 or T2 relationship. In the interest of getting down to layman terminology and simplifying the subject, we have abridged that flowchart to a more basic version.

Do you have a T1 provider?

Do you have a T2 provider?

Lets make some assumptions and head down the path of worst-case scenarios. Assume that the proposed rules pass without substantive change or perhaps get even more punitive toward T1 and/or T2 entities. What might the implication be for your campus?

To state the question another way, “what if my provider goes away?”